Insight · 23 October 2023

Rethinking additionality: or how is buying clean energy like buying oat milk?

By Toby Ferenczi

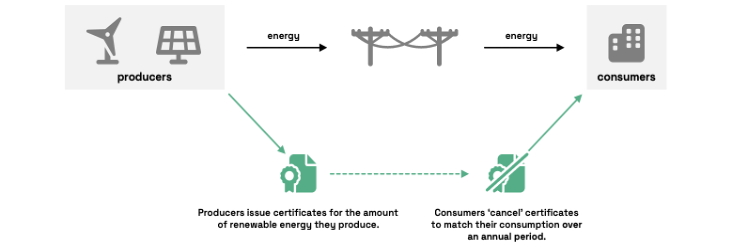

Choosing where your energy comes from is perhaps the most important consumer choice there is. Whether you’re a business or an individual, one of the best ways to reduce your carbon emissions is to buy energy from carbon-free sources rather than from fossil-fuels. Thanks to ‘Energy Attribute Certificates’ (EACs - also called RECs or GOs) there is a reliable verification mechanism that enables consumers to make this choice.

The way EACs work is that a certificate is created for each measured unit of clean energy generated, enabling consumers (or energy suppliers on their behalf) to purchase these certificates and claim that an equivalent unit of their consumption has come from that source without risk of double counting.

As more businesses set net-zero targets the demand for clean energy and EACs has been booming – the global market size doubled in 2022 to $24bn [1]. As the price of these certificates has increased they have become an increasingly important revenue stream for renewable energy developers.

Understandably, there is a lot of debate about the impact of these purchases. How do you know that by buying clean energy you are really making a difference?

A commonly held view is that it’s important to show ‘additionality’, this refers to whether a procurement decision has an impact relative to a baseline. When applied to energy procurement, some believe that to be ‘additional’ there needs to be a one-to-one relationship between that decision and the construction of a new renewable generation asset. Demonstrating this is often tricky however given the lack of a reliable ‘baseline’ to compare against – see Olivier Corradi’s excellent post on the topic.

By looking at the market drivers of the build-out of new clean energy resources, in fact all consumers of clean energy can have an important impact on the transition to clean energy without the need for there to be this 1-to-1 relationship.

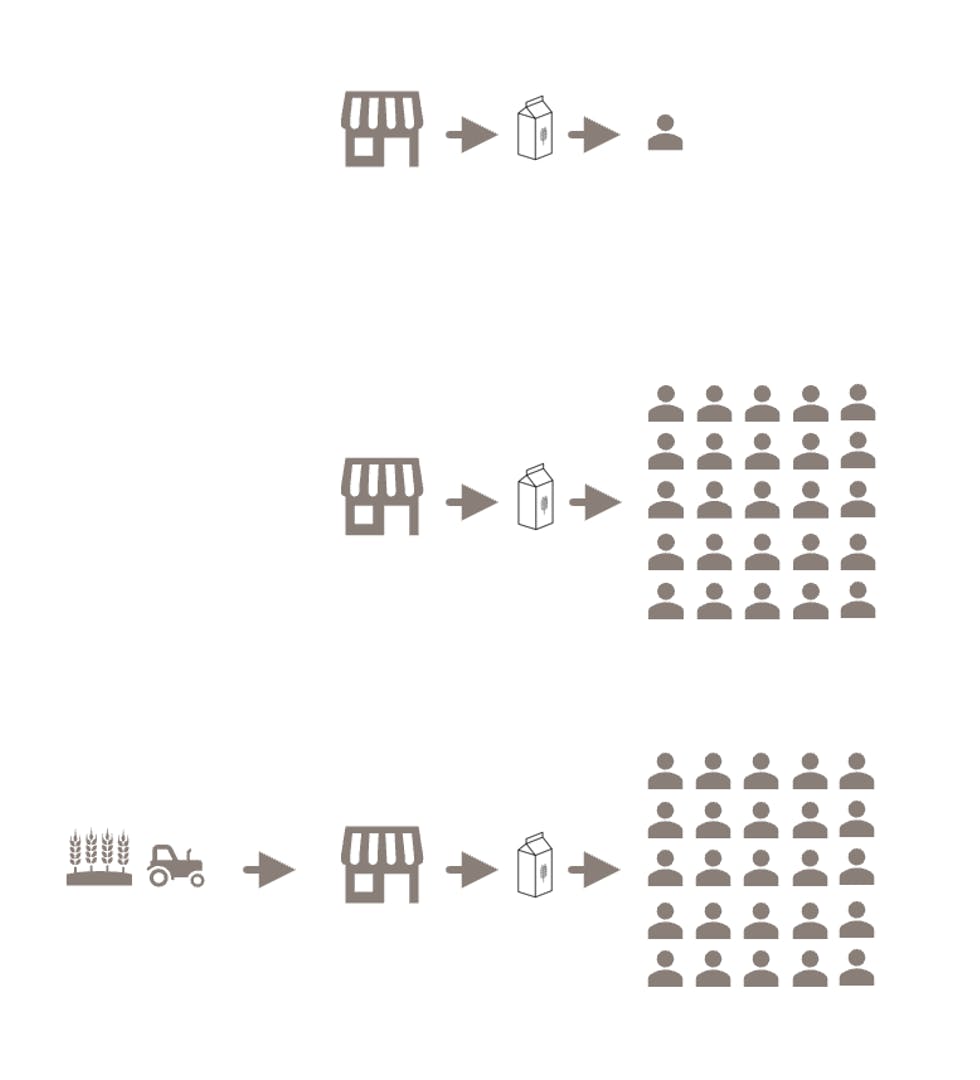

To understand these drivers, it’s helpful to compare with other commodity markets; let’s take oat milk as an example. As more consumers have begun buying oat milk, oat milk producers have responded by increasing production. Even though an individual purchase of oat milk from the grocery store won’t cause a new oat milk factory to be built, on aggregate, these purchases send an important demand signal that ultimately leads to more production.

This highlights an important role for the retailers (whether that’s Whole Foods or an energy utility) who can aggregate demand and sign long-term agreements with producers to enable them to finance the construction of new production facilities – as long as their customers keep buying oat milk. Therefore, there’s no need for individual consumers to sign a 10-year oat milk agreement themselves, just as they don’t need to sign a 10-year power purchase agreement to have a benefit on the energy system (although it’s obviously great if you can). Nor do consumers need to only buy oat milk from factories that are less than two years old, for instance, as that would create a much less effective demand signal. The most important thing is to keep buying oat milk!

One of the historical concerns raised with EACs is that at times there has been oversupply from large power plants built a long time ago e.g. old hydro power stations. RE100’s criteria that EACs should come from plants less than 15 years old could make some sense here, as this is a long-enough revenue stream to support project financing, but also excludes the plants that were built and financed a long time ago. On a related the topic, the criteria for subsidising the construction of electrolysers for producing ‘green hydrogen’ are a special case, since this is a massive amount of new load which would only be built because of the subsidy and is ostensibly to reduce carbon emissions.

Liquid markets are essential. Long-term offtake contracts enable the financing of new production assets, however to get them across the line industry players need to see there is also reliable demand from many other players outside of long-term agreements. It gives them confidence they could sell excess commodity (oat milk, or energy) on an open market. This allows them to take long-term volume risk and set-up large volume production. So it’s actually very important for liquidity that not all purchases are part of long-term agreements.

Moving from annual matching to hourly matching

Another way to improve the effectiveness of the price signal created by EACs is to enhance their granularity. As some may be aware, we at Granular Energy have been advocating for a transition from today’s practice of matching EACs on an annual basis to an hourly or sub-hourly basis. Annual matching effectively means ‘100% renewable’ claims can be made through buying EACs from a solar farm in summer, and “using” those EACs at night-time in winter. This isn’t reflective of the physical reality of the grid, which sees over-production of renewables at certain times and the use of fossil-powered back-up generation at others, leading to distrust in these claims.

It also doesn’t deliver an effective price signal to the market. Clean energy should be cheap when in oversupply, and more expensive when in undersupply – this isn’t the case with the current system. By adding a timestamp to certificates, consumers can trace where their energy comes from by the hour, and by purchasing clean energy they can support the build out, not only of more renewable energy generation, but also of the other technologies that we need to decarbonize the grid like energy storage and flexibility.

Making the supply and demand matching more granular and reflective of the physical reality makes for a much more effective price signal.

Buying clean energy in a specific hour sends a demand-signal through the market that, on aggregate, leads to greater supply of clean energy at the times when we need it most, from whichever technology can most cost-effectively deliver it.

For further reading on the links between EACs and wholesale power markets and the benefits of hourly energy certificates, check out our whitepaper with the European power market operator NordPool and the consultancy AFRY.

[1] https://www.custommarketinsights.com/report/renewable-energy-certificate-market/

Share article

More insights

Press · 15.01.2026

Redefining Scope 2: Inside the GHG Protocol Update

Scope 2 is changing. The Greenhouse Gas Protocol is proposing updated guidance that could reshape how companies report electricity emissions and make carbon-free energy claims.

Press · 14.01.2026

LichtBlick x Granular Energy

Granular Energy is pleased to announce the signing of a long-term partnership with LichtBlick, Germany’s biggest supplier offering only renewable electricity.