Insight · 15 July 2025

Introducing Shaped EACs: a new tradeable instrument for deep decarbonisation

This week, we have announced a first-of-a-kind clean energy transaction. This post provides some further background behind our announcement on Shaped EACs.

To enhance the transparency and traceability of energy sources, Granular Energy, with TotalEnergies Gas & Power and Shroders Greencoat, has completed the first-ever transaction of a Shaped Energy Attribute Certificate ("Shaped EAC"). This article dives into the detail of why this matters and what it means for EAC markets.

The problem

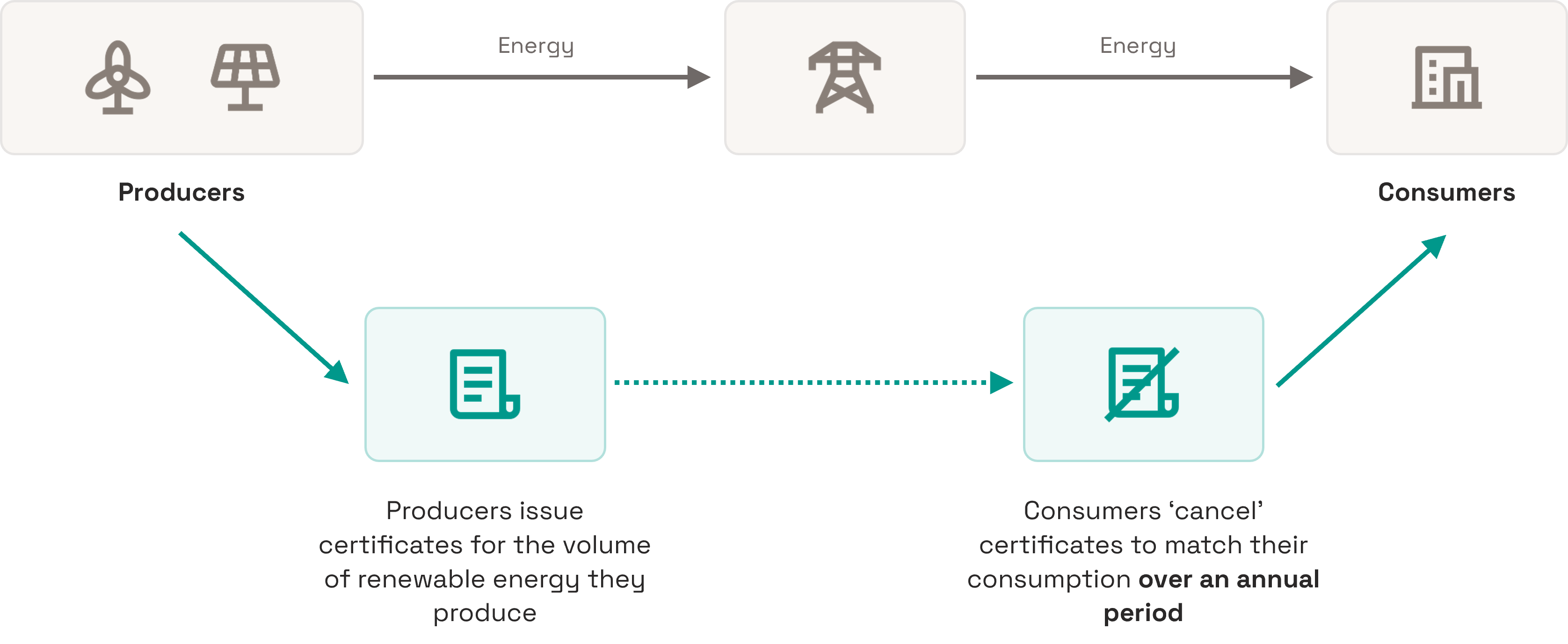

Whenever electricity is transacted, Energy Attribute Certificates (otherwise known as RECs, GOs, REGOs or iRECs) are the instruments used to verify where each unit (MWh) of electricity has come from. Consumers (or energy suppliers on behalf of consumers) can purchase these receipts and match them with a unit of consumption, so that they can reliably verify that the energy they purchased came from a specific source, without risk of double counting.

EACs allow consumers to choose the source of the electricity they use

EACs provide a lot of information about the source of the energy (technology type, location, age of power plant etc), however they typically only include the month of energy production, not specific dates or times for when that energy was produced. Consequently, this information is lost, meaning that buyers are unaware of the correlation between when they consumed the electricity and when it was produced. Until recently, this hasn’t been seen as a significant problem, since consumers and energy suppliers often claim to be 100% renewable based on annual matching of supply and demand. This has been called into question however, since it does not reflect the physical availability of renewable energy, and implies, for instance, that solar energy can be consumed during the night, which is clearly questionable.

Recently, there is a growing to move to hourly matching, with many energy suppliers starting to offer hourly matching tariffs for their customers (for a selection, see this link). New standards, such as the Climate Group’s 24/7 Carbon-Free Coalition, SBTi, and the Greenhouse Gas Protocol, are moving towards hourly matching. To learn more about why time-matching is important – read our primer here.

In parallel, there are significant efforts to encourage official EAC issuers to add the missing temporal information to EACs (aka granular certificates). Several issuers have begun to make GCs available such as PJM (US) or Energinet (Denmark), and the list is growing. Despite this progress, it is still expected to take some time for a widespread roll-out of GCs everywhere, so Shaped EACs provide an immediate solution to this problem.

What is a Shaped EAC?

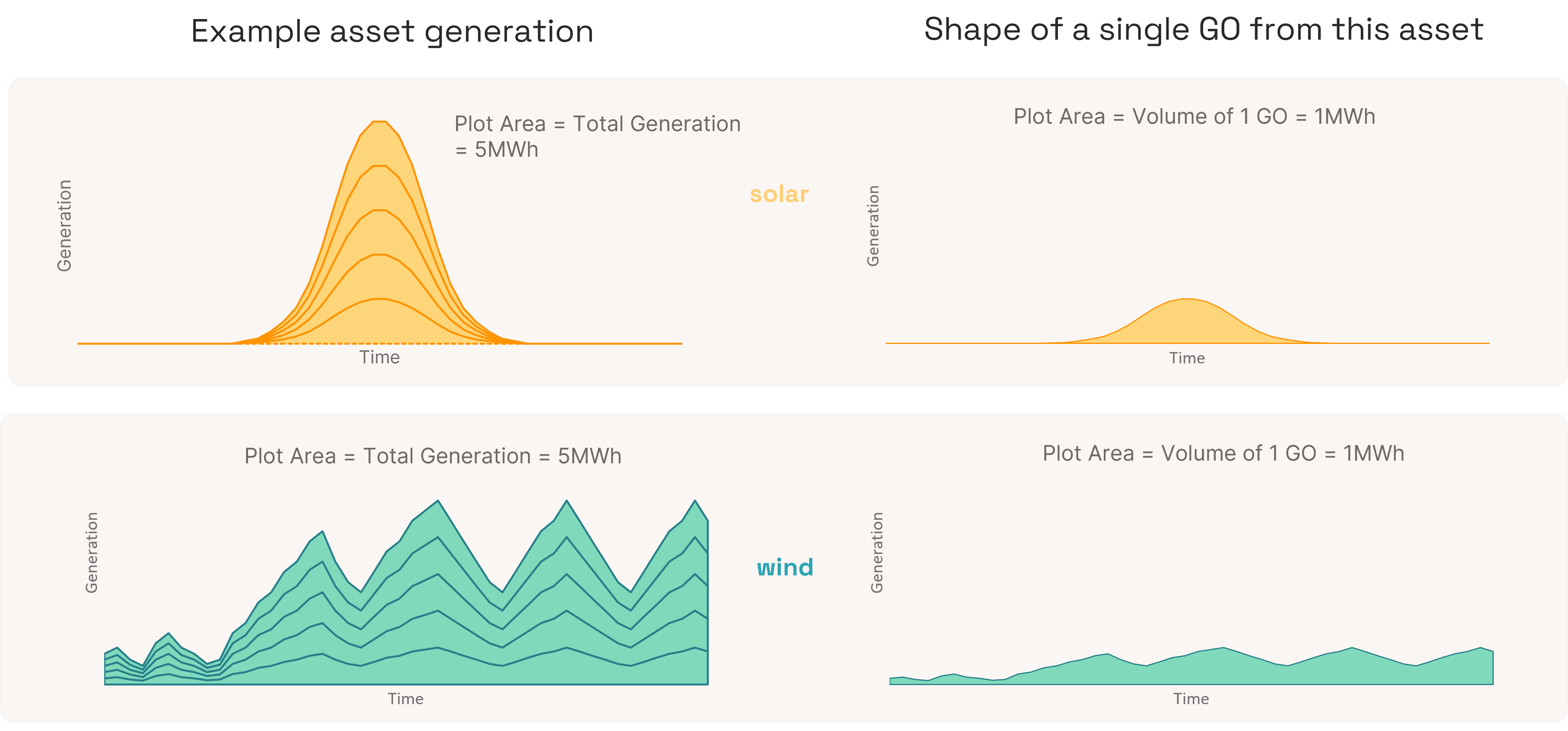

A Shaped EAC is defined as an EAC that comes with the relevant hourly or sub-hourly production data, and importantly, the contractual right for the buyer to claim the benefit of the shape of the production.

All EACs typically include information regarding the specific generation asset, the location, the technology and the month when the energy was produced, but not the time. Meanwhile, half-hourly or 15-minute interval production data is nearly always recorded and used in the settlement process for the local power market. A Shaped EAC simply combines the pro-rata, proportional ‘shape’ of production data with the monthly EAC and gives the buyer the right to claim the corresponding hourly generation volumes and commits not to have sold the same rights to another party. See the diagram below for an illustration of how this works in practice.

EACs with enhanced with hourly metering data have an hourly “shape”

Shaped EACs from a specific asset in a specific month are identical, so that if they are sold to multiple counterparties, there is no risk that some counterparties may be unwittingly negatively impacted by the hourly claims of another. Therefore, it removes the risk of ‘cherry-picking’ the best hours from the shape of the asset. This also makes Shaped EACs a credible tradable instrument. Shaped EACs bring the concept of energy certificates into alignment with the physical, real-world availability of renewable energy, making them a much more credible tool to underpin energy transactions.

Why is this important?

Energy buyers are becoming increasingly interested in the temporal correlation between their consumption and the energy they are buying (their hourly-matching score) to meet new, emerging clean energy standards such as the 24/7 Carbon-Free Coalition Criteria from the Climate Group which specifically references the need for ‘shape preservation’ when making claims using EACs.

Other standards bodies such as the Greenhouse Gas Protocol Scope 2 update and the Science Based Targets Initiative (section C15.4) are also leaning towards time matching. Many energy suppliers are now offering hourly-matched clean energy products.

When EACs are traded today, they do not include access or rights to the production data, preventing them from being used time-matching products or claims. Shaped EACs remove this potential barrier to widespread time-matching of clean energy.

What are the benefits?

For sellers of renewable energy, offering Shaped EACs, rather than standard EACs will make your available volumes more attractive to the market without any downsides.

For buyers, Shaped EACs are a way to avoid having stranded inventory that cannot be used to comply with the latest standards in clean energy procurement.

For energy storage developers that can provide clean energy at times when it is in short supply, there are also additional benefits. See for instance our blog post on how batteries can benefit from this market.

How do I participate?

If you are interested in potentially participating in either buying or selling Shaped EACs, read our information page and please register your interest by filling in the form here.

Granular Energy works with many of the world’s largest energy companies, and we are able to facilitate Shaped EAC transactions through our EAC management platform and marketplace.

What does this mean for the future?

Shaped EACs are a step towards widespread adoption of granular accounting, which we believe will bring forward the arrival of a 24/7 carbon-free grid by providing an incentive for technologies that can deliver clean energy in times and places where it is most needed.

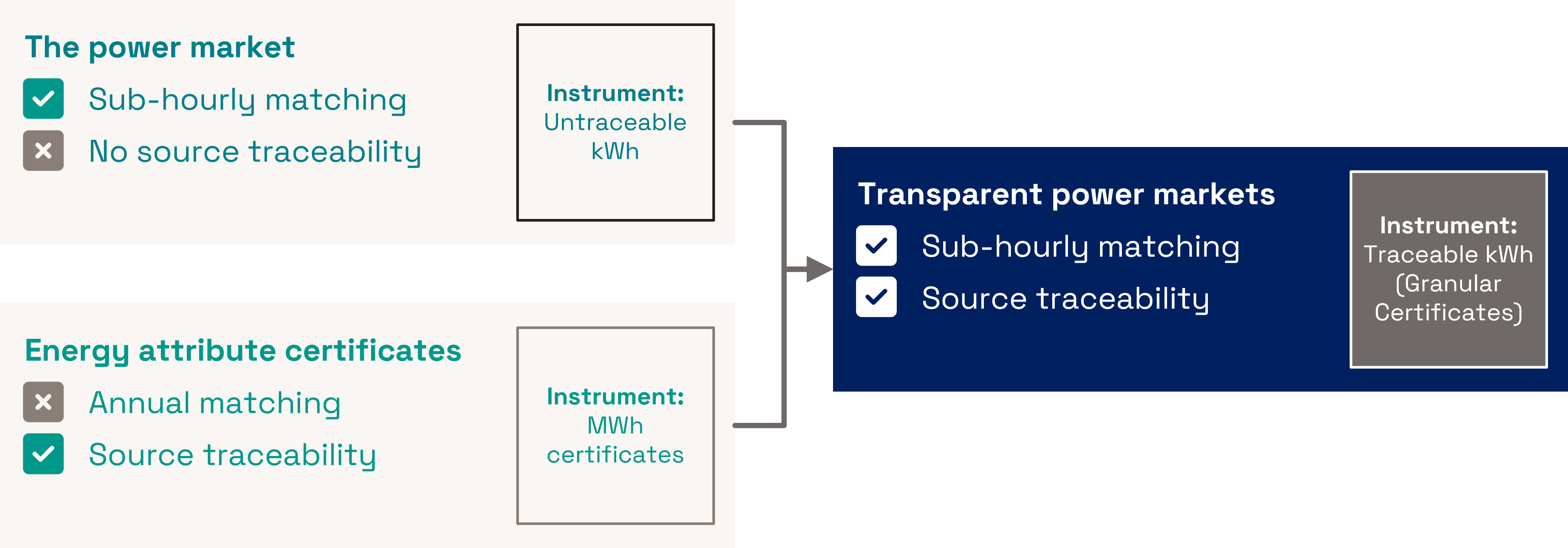

Traditional power markets, whilst providing a 30-minute or 15-minute price signal, don’t distinguish between clean or fossil-based sources of energy (by definition, all power is ‘pooled’ together). EACs, on the other hand, provide traceability, but on an annual matching basis.

Today, two parallel and unconnected markets are used to match production and consumption. Time-stamped energy certificates bring traceability to power market transactions and create an important price signal for technologies that deliver clean energy when its needed.

Granular certificates and Shaped EACs align certificates with power markets, paving the way for genuinely bundled energy transactions. Looking forward, Shaped EAC transactions could also be considered ‘micro-PPAs’ if volumes are also settled physically or have a price linked to the wholesale power price.

Share article

More insights

Case study · 05.02.2026

Building the digital backbone for energy attributes certificates: South Pole and Granular Energy partnership

Granular Energy is pleased to announce a new partnership with South Pole. This collaboration marks an important innovative step in renewable energy certificate management across global markets.

News · 03.02.2026

Carbon-Free Chronicles January 2026: The essential round-up of news and reports relating to hourly transparency

We’re back with our Carbon-Free Chronicles, and as we move into 2026, the focus across energy markets is shifting from consultation and experimentation to implementation. Reporting deadlines have passed, policy signals are sharpening, and the market is moving. The direction of travel is clear: higher-quality, time-matched clean energy claims are moving from “nice to have” to “expected”.